We have 250 fewer oil rigs that are functioning today than we did before the pandemic, and yet, the oil and gas industry has leases on 23 million acres of public land on and offshore. At the same time, the energy industry is making enormous profits. They're back up to above where they were before the pandemic started.

The above statement reads like a complaint by a disgruntled business executive from an industry that is in direct competition with U.S. oil and gas. It is, in fact, a response by U.S. energy secretary Jennifer Granholm to a reporter’s question about “…why hasn't domestic production returned in a way that would lower prices?”

Now, I realise that a lot of government officials across the world rely on people being incapable of retaining information for more than week but the Biden administration’s campaign in 2020 focused, among other things, on squeezing the oil and gas industry in order to usher in a new era of renewable energy. One of the first orders of business of President Biden was to impose a moratorium on federal land leasing for oil and gas drilling and try to keep it in place after it was challenged in court.

Against this background, Secretary Granholm’s above statement sounds, to put it mildly, confusing. It becomes a little less confusing in the context of rising retail fuel prices for American drivers (read voters) but confusion returns with a vengeance when one recalls the White House calls on OPEC to increase oil production and Occidental’s CEO’s suggestion that "if I were gonna make a call [about oil production], it wouldn't be long-distance, it would be a local call."

But fast-forward to this week and we have Secretary Granholm singing a completely different tune. Speaking to the National Petroleum Council, Granholm said "I do not want to fight with any of you. I do think it's much more productive to work together on future-facing solutions."

"While I understand you may disagree with some of our policies, it doesn't mean the Biden administration is standing in the way of your efforts to help meet current demand," she added and then openly asked the industry to pump more oil.

Consumers, as you know, are hurting at the pump. I hope you will hear me say that please, take advantage of the leases that you have, hire workers, get your rig count up.

Not a word about profits. Not a word about climate change and how the U.S. needs to produce less oil and gas to slow down this change. And not a word about the White House asking OPEC for help first instead of the local industry. Reality once again reasserted itself amid noble visions of emission-free, electricity-powered nations. And if we are to believe Aramco’s CEO, it’s about to reassert itself a lot more painfully in the future.

Amin Nasser, like many fellow oil and gas executives, seems to have had it with the green illusions of governments and was perfectly blunt during the World Petroleum Congress in Houston last week, saying:

I understand that publicly admitting that oil and gas will play an essential and significant role during the transition and beyond will be hard for some. But admitting this reality will be far easier than dealing with energy insecurity, rampant inflation and social unrest as the prices become intolerably high and seeing net zero commitments by countries start to unravel.

Now, one could of course argue that being the chief executive of the world’s largest oil company hardly makes Nasser an impartial commentator but let’s look elsewhere and see if there’s any truth in his words.

Europe is still struggling with record gas and electricity prices and its struggle is becoming increasingly difficult. Germany has threatened Russia to shutter Nord Stream 2 if Moscow doesn’t mend its ways in Ukraine and if this sounds like weaponising an energy project, it’s because it is, only the weaponiser is not the one you would expect. France has shut down two nuclear plants on evidence of corrosion. And gas reserves are down to 63% of storage capacity, from 75% in October. And the weather right now is milder than usual for this time of the year but likely about to get colder as it does every winter.

In the meantime, EU member states are arguing whether or not nuclear energy should be included in the list of clean energy sources, with a majority supporting the idea but environmentalists crying toxic waste. The two biggest economies in the union are at odds on nuclear, which makes EDF’s recent corrosion problems even more unfortunate. Germany’s new government is firmly against nuclear. France derives more than two-thirds of its energy from nuclear power plants. For now, everything is amicable but some day the differences will need to be settled.

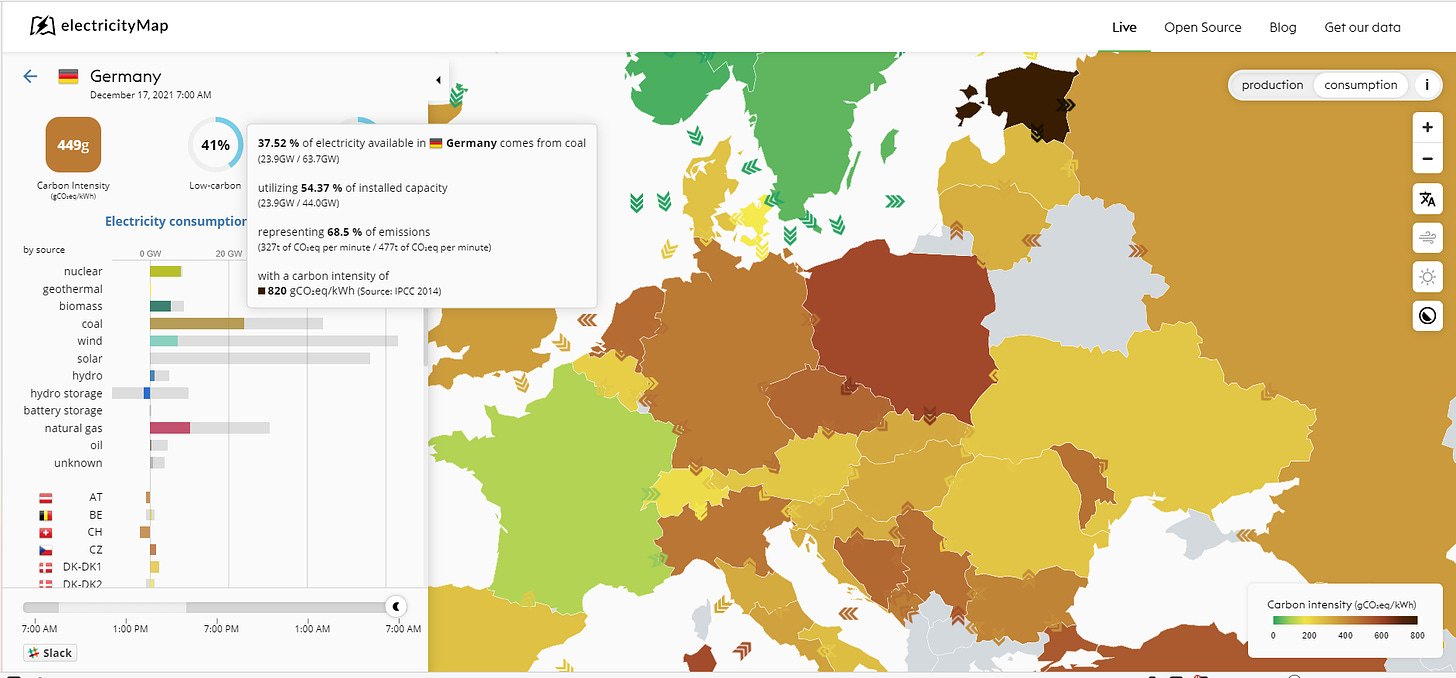

Also in the meantime, carbon permit prices are also soaring thanks to utilities’ forced switch to coal from gas because of the price problem. Interestingly, not a single official, not even the IEA’s Fatih Birol, has said a word about renewables and their contribution to Europe’s energy supply in these difficult times. That’s probably because as of the time of writing this, Germany was generating the bulk of its electricity from coal, with zero solar output and wind accounting for 11% of the total.

A fun discovery I made while inserting the above image was an older screenshot from electricityMap made in June. Let’s have a look.

Germany is consistently* generating more electricity from coal than from wind and solar. Germany plans to retire all of its coal power plants by 2038 but it hopes it can do it three years earlier.

*If the fact wind and solar generated more energy than fossil fuel plants on a certain day is news, then they are not the dominant source of electricity.

Let’s go back to Nasser’s grim predictions.

The world is facing an ever more chaotic energy transition centred on highly unrealistic scenarios and assumptions about the future of energy.

These are the words of one oil executive who’s had enough and he is hardly the only one. The oil and gas industry has been demonised to an extent not seen since the anti-nuclear crusade a few decades ago. It’s very likely that in the public consciousness it has come to be the single party responsible for all the harm human civilisation has done to the environment even though this is a dangerously simplistic view to put it mildly.

Yet those demonising oil and gas continue guzzling them like the best of the polluters in Asia. Because there is no viable alternative. And there is no viable alternative because the transition is being done in a rushed, hectic manner. The result of doing things in a rush, hectically, is chaos.

Here’s another example of why a slapdash attitude is not exactly productive. The most fervent proponents of the energy transition from various industries and also from Brussels and London have insisted that high carbon prices are an instrument of this transition. The more expensive carbon becomes, the argument goes, the more motivated polluters would be to clean up their act and invest in low-carbon alternatives.

In theory, the argument makes perfect sense. In practice, the UK recently had to trigger a mechanism that could have seen government intervention to cap the price of carbon. Because it had surged too high. Yet the authorities decided not to intervene, even though carbon prices remain elevated, at the expense of all businesses obliged to buy carbon permits because the excessive gas prices have made them switch to other fuels, none of them renewable. Several power utilities in the country have already gone under, by the way.

Meanwhile across the Channel, EU member states are arguing about the emission trading scheme, with the poorer nations refusing to bear the brunt of their wealthier neighbours’ decarbonisation ambitions. Since I can’t put it better than the FT, here’s a qoute about what the argument is about:

At the heart of the EU’s net zero plan is a an extension of the ETS to cover sectors such as cars and housing. The proposal is opposed by France, Spain, Portugal and eastern European countries who say it will impose a direct tax on consumers who cannot afford to switch vehicles or domestic goods to those with lower emissions.

This is the fruit of rushing into things, which, however, has not deterred decarbonisation fans from seeing the silver lining. Record carbon prices are making expensive low carbon tech more economical or rather, less expensive in relative terms. What they sadly albeit understandably omit is the fact that households pay their electricity bills in absolute rather than relative terms.

Well done Irina. We need more voices telling the truth about renewables. Cheers